- Lesson 3: tax purpose- this one is just temporary? I think this factor may not be that big, but still not a temporary one.

- Case Study C: Convincing Shin Stores to consider Buying Kwon Stores

- Task 1: What arguments will you provide to Shin Stores management in order to encourage them to consider an acquisition of Kwon Stores?

- Acquisition is easier/ less risky/ cut cost to grow the business and takeover customers. If we do not do this, the customers will be taken by other competitors against us.

- Task 2: You are a major (10%) stockholder in Shin Stores. You are a conservative investor, what arguments will you make against Shin Stores looking at a Kwon Stores deal?

- We will build the customer base by ourselves which is more steady. Plus, it is hard to take a totally different business into our business for us, as we do not have such experience. / overpay

3. Case study D:

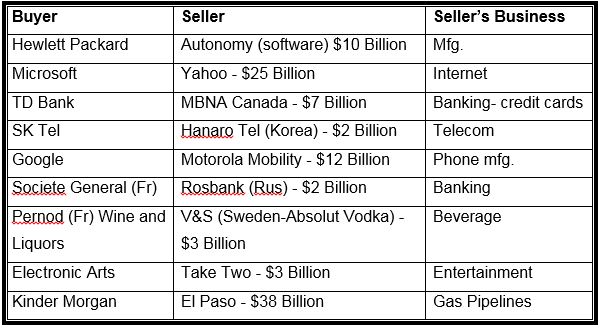

- Buy competition (market share): Microsoft v. Yahoo, Societe v. Rosbank, TD v. MBNA, SK Tel v. Hanaro Tel, Kinder v. El Paso

- Product line extension: HP v. Autonomy, EA v. Take Two, Pernod v. V&S, Google v. Motorola

- Roll-up:

Google v. Motorola - Strategic (diversification):

HP v. Autonomy,Microsoft v. Yahoo,Google v. Motorola - Private equity:

Kinder v. El Paso

the course gets better after lesson 3

ReplyDelete